Living and Business in Luxembourg

OPEN, DIVERSIFIED AND RELIABLE COUNTRY

For more than two decades, Luxembourg’s economy has consistently punched above its weight, with strong growth and trade surpluses, low unemployment and inflation in a stable, innovative environment for business and consumers alike, repeatedly out-performing neighbouring countries.

Thanks to fast and flexible action by Luxembourg’s Government and the private sector, stability has been maintained throughout the global economic and financial crisis. The country boasts the highest per capita income in the OECD, growth in employment in the financial sector and a domestic banking system that remains well capitalised by international standards. Luxembourg was upgraded to an AAA by credit rating agency Standard & Poor’s in 2013.

REWARDING TAX ENVIRONMENT

Luxembourg’s legal and tax environment is a principal attraction for companies looking for a location for their headquarters. The country has developed favourable tax rules for both corporations and individuals.

Companies in Luxembourg are subject to a 29.22% corporate income tax rate. In Luxembourg City, the maximum effective overall tax rate is 28%.

According to a recent report by the World Bank and PwC on total tax rates, which compared business taxes and pre-tax profits, Luxembourg ranked lowest in the EU. Luxembourg ranks 14th out of 183 economies worldwide and is the best in Europe for average tax liabilities and time required to file tax returns.

COMPARISON OF THE TOTAL TAX RATES ACROSS THE EU source: World Bank/PWC, Paying Taxes 2012

source: World Bank/PWC, Paying Taxes 2012

COMPARISON OF THE TOTAL TAX RATES ACROSS THE EU

source: World Bank/PWC, Paying Taxes 2012

source: World Bank/PWC, Paying Taxes 2012

A FAVOURABLE TAX REGIME

Taxation in Luxembourg of foreign-source income is eased through numerous double taxation treaties. If no treaty applies, a foreign tax credit is available under domestic law.

LUXEMBOURG’S DOUBLE TAX TREATY NETWORK source: World Bank/PWC, Paying Taxes 2012

source: World Bank/PWC, Paying Taxes 2012

Luxembourg does not impose any withholding tax on the payment of interest, except for very specific cases. There is no withholding tax on royalties paid to resident or non-resident companies related to patents, trademarks and know-how. Furthermore, there is no withholding tax on liquidation proceeds. The country has a favourable tax regime for income, gains or net worth related to the substantial holding of shareholdings. Under the participation exemption regime, there is an exemption from Luxembourg corporate income tax on dividends received from qualifying entities in the European Union or treaty-related countries (under certain conditions). Likewise, capital gains derived from the sale of qualifying participations can be exempt. In certain cases, the amounts received upon the partial or total liquidation of a subsidiary may also benefit from the participation exemption. Luxembourg encourages operational companies to invest in their production assets. A 7% tax credit is granted on qualifying investments acquired over a year (and 3% on the amount of the investment exceeding €150 000). For investment in ecological equipment and projects, these rates are increased by a further 1%. In addition, a tax credit of 13% is granted for additional investments made during the tax year. These tax credits reduce the corporate income tax and if unused may be carried forward for 10 years.

LUXEMBOURG’S DOUBLE TAX TREATY NETWORK

source: World Bank/PWC, Paying Taxes 2012

source: World Bank/PWC, Paying Taxes 2012

Luxembourg does not impose any withholding tax on the payment of interest, except for very specific cases. There is no withholding tax on royalties paid to resident or non-resident companies related to patents, trademarks and know-how. Furthermore, there is no withholding tax on liquidation proceeds. The country has a favourable tax regime for income, gains or net worth related to the substantial holding of shareholdings. Under the participation exemption regime, there is an exemption from Luxembourg corporate income tax on dividends received from qualifying entities in the European Union or treaty-related countries (under certain conditions). Likewise, capital gains derived from the sale of qualifying participations can be exempt. In certain cases, the amounts received upon the partial or total liquidation of a subsidiary may also benefit from the participation exemption. Luxembourg encourages operational companies to invest in their production assets. A 7% tax credit is granted on qualifying investments acquired over a year (and 3% on the amount of the investment exceeding €150 000). For investment in ecological equipment and projects, these rates are increased by a further 1%. In addition, a tax credit of 13% is granted for additional investments made during the tax year. These tax credits reduce the corporate income tax and if unused may be carried forward for 10 years.

ATTRACTIVE LABOUR COSTS

An employee in Luxembourg would cost less to the employer and get a higher salary than in other EU countries due to low personal income tax and social security charges. Yet, high social security benefits allow most Luxembourg employees not to require additional private health insurance.

A recent PwC survey showed a married couple with two children could expect to receive 73% of their gross salary at a total cost of 116% to the employer. This compares to 62%/119% in Germany and 71%/191% in France.

SPECIAL TAX TREATMENT FOR INCOME FROM IP RIGHTS

A tax scheme to foster innovation and intellectual property management includes an 80% exemption of income from the use, exploitation and/or disposal of qualifying IP rights, bringing the effective tax rate down to 5.76%.

Following situations are covered:

The exemption regime applies to income from patents, trademarks, designs, models, software copyrights and domain names. Moreover, these IP rights are fully exempt from net worth tax.

Following situations are covered:

- The remuneration for exploitation of IP rights;

- The use of IP rights by a company for its own activity;

- The disposal of IP rights.

The exemption regime applies to income from patents, trademarks, designs, models, software copyrights and domain names. Moreover, these IP rights are fully exempt from net worth tax.

STABLE AND RELIABLE BUSINESS ENVIRONMENT

Luxembourg’s strong performance, even during economic downturns, is founded on shrewd policies. Diversification has been a major priority since the 1960s, when the country began to move away from its reliance on the steel industry into high-tech manufacturing and banking. Today’s economy is a balanced blend of financial services, high value-added manufacturing, retail, e-commerce, communications and logistics services, with a focus on exporting goods and services throughout the European Union and beyond.

Stability is another key feature. The Government fosters close relationships with industry and business to identify, understand and answer challenges. Luxembourg’s well-established “tripartite” system brings together the Government, employers and unions to discuss important issues and reach consensus. Employer-employee dialogue is institutionalised as part of the “Luxembourg model”, with an emphasis on negotiation and compromise rather than costly disruptions.

The stability of the Government’s finances is just as important. Like taxes, public debt is low -- in 2011 it numbered just 18% of total GDP, among the lowest in the European Union. Corporate taxes support investment and entrepreneurship, with top rates of 28% (2013), while effective rates can be as low as a single digit. Value-added tax at a standard rate of 15% (2013) is the lowest in the EU.

Stability is another key feature. The Government fosters close relationships with industry and business to identify, understand and answer challenges. Luxembourg’s well-established “tripartite” system brings together the Government, employers and unions to discuss important issues and reach consensus. Employer-employee dialogue is institutionalised as part of the “Luxembourg model”, with an emphasis on negotiation and compromise rather than costly disruptions.

The stability of the Government’s finances is just as important. Like taxes, public debt is low -- in 2011 it numbered just 18% of total GDP, among the lowest in the European Union. Corporate taxes support investment and entrepreneurship, with top rates of 28% (2013), while effective rates can be as low as a single digit. Value-added tax at a standard rate of 15% (2013) is the lowest in the EU.

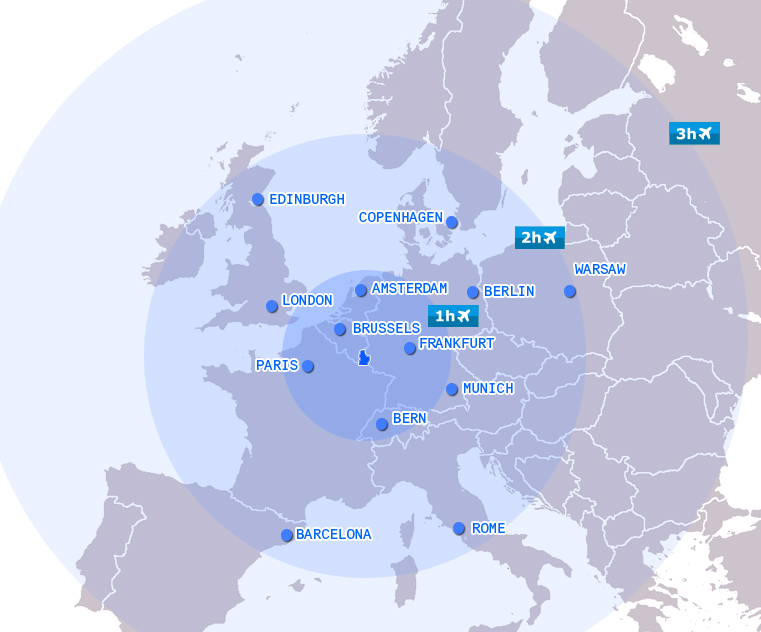

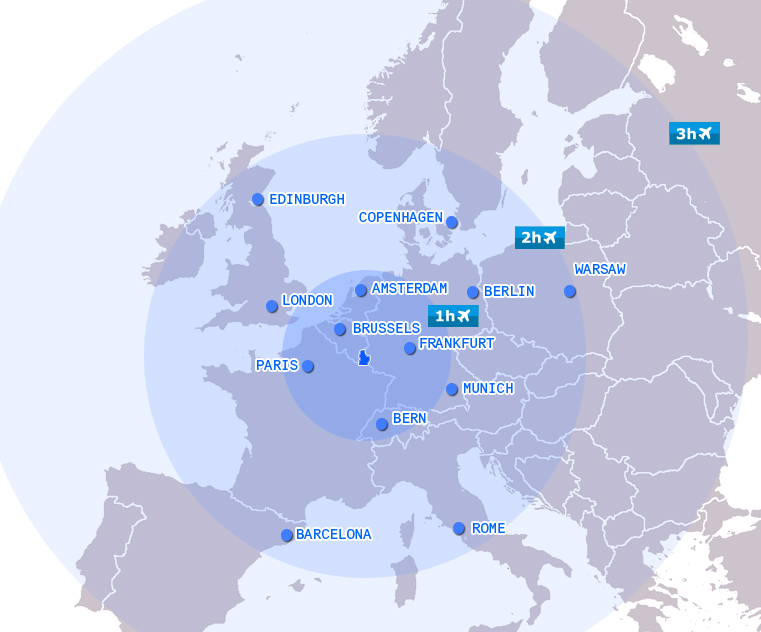

A STRATEGIC GATEWAY TO EUROPE

Located at the heart of Europe, with the continent’s three top industrialised nations as its neighbours, Luxembourg is the ideal gateway to a European market with 500-million-plus consumers. Thanks to this fortuitous geography, 80% of the European Union’s GDP can be served within less than a day. Taking full advantage of this opportunity, Luxembourg has established itself as a key hub for logistics, ICT, life sciences, clean technologies and IP.

Markets and decision-making centres are close by: It takes just over two hours to reach Paris by high-speed train; by plane, London and Milan are 90 minutes away, while Frankfurt is a mere 30-minute flight. Closer to home, the neighbouring countries form part of a “Greater Region” which looks to Luxembourg as an economic engine. The region is a rich source of skills with more than 150,000 commuters crossing into Luxembourg each day.

Global and regional road, rail, air and telecommunications infrastructure are all first rate and backed with generous government support. Cargo airlines serving Luxembourg airport fly to some 100 destinations on all continents. The country has one of Europe’s highest rates of broadband internet use and the “backbone” connections with the rest of the world are ensured state-of-the-art by substantial private and public investment.

In addition to home-grown global industry leaders ArcelorMittal, RTL Group and SES, many other varied businesses have chosen Luxembourg for their European headquarters, including internet telephony leader Skype, car components manufacturer Delphi, online retailer Amazon and glassmaker Guardian.

Luxembourg is one of the three administrative capitals of the European Union and home to major institutions, including the European Court of Justice, the European Investment Bank, the European Court of Auditors among other administrative departments of the European Commission and the European Parliament.

Markets and decision-making centres are close by: It takes just over two hours to reach Paris by high-speed train; by plane, London and Milan are 90 minutes away, while Frankfurt is a mere 30-minute flight. Closer to home, the neighbouring countries form part of a “Greater Region” which looks to Luxembourg as an economic engine. The region is a rich source of skills with more than 150,000 commuters crossing into Luxembourg each day.

Global and regional road, rail, air and telecommunications infrastructure are all first rate and backed with generous government support. Cargo airlines serving Luxembourg airport fly to some 100 destinations on all continents. The country has one of Europe’s highest rates of broadband internet use and the “backbone” connections with the rest of the world are ensured state-of-the-art by substantial private and public investment.

In addition to home-grown global industry leaders ArcelorMittal, RTL Group and SES, many other varied businesses have chosen Luxembourg for their European headquarters, including internet telephony leader Skype, car components manufacturer Delphi, online retailer Amazon and glassmaker Guardian.

Luxembourg is one of the three administrative capitals of the European Union and home to major institutions, including the European Court of Justice, the European Investment Bank, the European Court of Auditors among other administrative departments of the European Commission and the European Parliament.

MULTILINGUAL WORKFORCE

Its diminutive size has compelled Luxembourg to look outward, becoming expert at importing knowledge via long-term immigrants and cross-border commuters. Of the more than half-million people living in the country, 44% are non-Luxembourgish and of the 368,400 people working here, 42% are non-resident commuters. Overall, this adds up to two-thirds of the workforce originating from outside the country.

A study from 2010 by the national statistics office shows that 36% of commuters had completed higher education and 50% had completed further secondary education, both figures above those for the resident workforce. Resident foreigners are a mix of the highly educated and unskilled manual workers. Immigrants come from around the world and offer employers a range of languages and cultural background.

The public school system educates children to a level of fluency in French, German, English and Luxembourgish. A national public university was established in 2003, with a special focus on post-graduate educational programmes and public research centres. Extensive life-long learning programmes to enable employees to acquire new skills receive extensive support from government and industry.

A study from 2010 by the national statistics office shows that 36% of commuters had completed higher education and 50% had completed further secondary education, both figures above those for the resident workforce. Resident foreigners are a mix of the highly educated and unskilled manual workers. Immigrants come from around the world and offer employers a range of languages and cultural background.

The public school system educates children to a level of fluency in French, German, English and Luxembourgish. A national public university was established in 2003, with a special focus on post-graduate educational programmes and public research centres. Extensive life-long learning programmes to enable employees to acquire new skills receive extensive support from government and industry.

UNPARALLEL QUALITY OF LIVING

One of the world’s smallest countries, and one of its wealthiest. An ultra-modern global financial capital and a UNESCO World Heritage site. The world’s only Grand Duchy and an international paragon of political stability and personal safety.

Graced by stunning, modern architecture literally a stone’s throw from medieval castles and graceful ruins, Luxembourg’s reputation as a fairy-tale land is rooted in more than 1,000 years of history – yet its 21st-century quality of life is legendary and well-deserved, as recognised in its position at or near the top of the Better Life Index (OECD), the Best Quality of Life Worldwide Survey (ECA), the Global Innovation Survey (Insead), and the Global Competitiveness Index (IMD), among others.

Luxembourg leads in virtually every aspect of contemporary life. Healthcare? Affordable and high quality. Transportation? A soaring, world-class airport with easy connections throughout Europe and the world, a well-developed rail system, an urban bus system and bike paths that enable you to leave your car at home, and an upcoming tram in the capital.

In a country whose inhabitants work hard on a global scale, there’s plenty of local play. From the rocky outcrops of “Little Switzerland” and rolling Moselle valley vineyards, with hundreds of trails for hiking and biking, to first-class gyms, sports facilities and children’s parks - staying fit and enjoying the outdoors is a popular pastime for all seasons.

There is also a range of sporting activities on offer, including six golf courses in the country and a further 90 or so within easy reach. Cross-country skiing is everywhere while world-class downhill skiing in the Alps is within a reasonable drive.

Sharing its borders with France, Germany and Belgium, weekend (and longer) tourism is a constant temptation (not to mention easy and fast access to all of Europe for holiday getaways). Reverse tourism is well developed in a country with a wide array of quality hotels for tourists as well as business visitors.

So whether you are coming to Luxembourg for a weekend, a year or a lifetime, you will fall under its spell.

For families, Luxembourg offers some of the best-funded public schools in the world, and first-rate private and international schools for children of virtually all nationalities and linguistic backgrounds. The well-funded health system regularly scores highly in international comparison surveys and society is peaceful, with very low rates of crime and a high feeling of personal security. (According to Mercer, Luxembourg ranks among the safest cities in the world.)

New laws on immigration and double nationality have opened new worlds for expatriates and their families. Since the reform in October 2008, the process for acquiring work and residence permits, and eventually citizenship, has been streamlined, with skilled talent now finding it easier to settle into an ever-more welcoming environment.

Graced by stunning, modern architecture literally a stone’s throw from medieval castles and graceful ruins, Luxembourg’s reputation as a fairy-tale land is rooted in more than 1,000 years of history – yet its 21st-century quality of life is legendary and well-deserved, as recognised in its position at or near the top of the Better Life Index (OECD), the Best Quality of Life Worldwide Survey (ECA), the Global Innovation Survey (Insead), and the Global Competitiveness Index (IMD), among others.

Luxembourg leads in virtually every aspect of contemporary life. Healthcare? Affordable and high quality. Transportation? A soaring, world-class airport with easy connections throughout Europe and the world, a well-developed rail system, an urban bus system and bike paths that enable you to leave your car at home, and an upcoming tram in the capital.

In a country whose inhabitants work hard on a global scale, there’s plenty of local play. From the rocky outcrops of “Little Switzerland” and rolling Moselle valley vineyards, with hundreds of trails for hiking and biking, to first-class gyms, sports facilities and children’s parks - staying fit and enjoying the outdoors is a popular pastime for all seasons.

There is also a range of sporting activities on offer, including six golf courses in the country and a further 90 or so within easy reach. Cross-country skiing is everywhere while world-class downhill skiing in the Alps is within a reasonable drive.

Sharing its borders with France, Germany and Belgium, weekend (and longer) tourism is a constant temptation (not to mention easy and fast access to all of Europe for holiday getaways). Reverse tourism is well developed in a country with a wide array of quality hotels for tourists as well as business visitors.

So whether you are coming to Luxembourg for a weekend, a year or a lifetime, you will fall under its spell.

For families, Luxembourg offers some of the best-funded public schools in the world, and first-rate private and international schools for children of virtually all nationalities and linguistic backgrounds. The well-funded health system regularly scores highly in international comparison surveys and society is peaceful, with very low rates of crime and a high feeling of personal security. (According to Mercer, Luxembourg ranks among the safest cities in the world.)

New laws on immigration and double nationality have opened new worlds for expatriates and their families. Since the reform in October 2008, the process for acquiring work and residence permits, and eventually citizenship, has been streamlined, with skilled talent now finding it easier to settle into an ever-more welcoming environment.

Reliable Country

Rewarding Tax Environment

A Favourable Tax Regime

Attractive Labour Costs

Special Tax Treatment

Reliable Business Environment

Strategic Gateway To Europe

Multilingual Workforce

Unparralel Quality Of Living

Contact Info

Address: L-3249, Rue J.F. Kennedy Bettembourg, Luxembourg

Telephones: +352 661 21 212

E-mail: info@trustpartners.lu